Despite a global pandemic, supply chain shocks, and rising geopolitical tensions, the payments industry revenue pool grew by 8.3% between 2017 and 2022 to reach $1.6 trillion. However, slower growth is on the horizon, according to new research by Boston Consulting Group (BCG). The report, titled Global Payments Report 2023 is being released today.

Despite a global pandemic, supply chain shocks, and rising geopolitical tensions, the payments industry revenue pool grew by 8.3% between 2017 and 2022 to reach $1.6 trillion. However, slower growth is on the horizon, according to new research by Boston Consulting Group (BCG). The report, titled Global Payments Report 2023 is being released today.

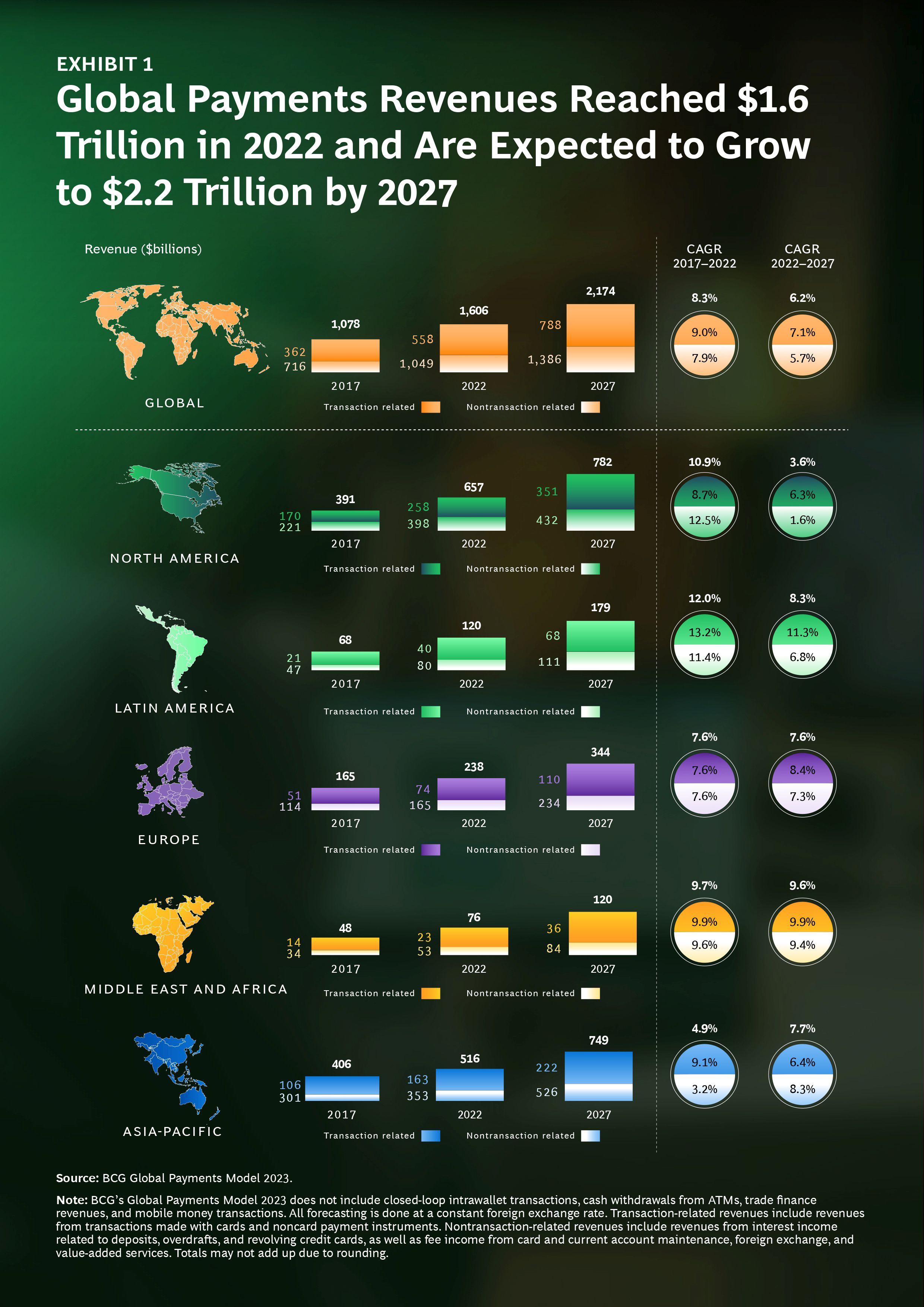

BCG’s 21st annual analysis of the global payments industry estimates that overall revenue growth will slow from today’s levels to a compound annual growth rate (CAGR) of 6.2% between now and 2027, taking the global revenue pool to $2.2 trillion. The report provides a comprehensive market outlook and examines the challenges facing acquirers, issuers, wholesale transaction banks, and payments infrastructure providers.

“This is a moment of truth for acquirers and merchant services providers, issuers, wholesale transaction banks, and payments infrastructure providers alike,” said Yann Sénant, global leader of BCG’s payments and fintech segment and coauthor of the report. “We are at the cusp of a GenAI-driven revolution for the payments industry with the potential for transformation of customer journeys and better targeted products holding the potential for better services and improved profitability.”

Tailwinds Are Turning

The last five years of growth in the global payments industry has been propelled by the ongoing cash-to-non-cash conversion, a rise in non-transaction revenue such as deposit-related income, the accelerated adoption of digital commerce, and the expanding implementation of modern payments infrastructure.

According to the report, transaction-related revenue is likely to grow by 7.1% through 2027, a drop of 1.9 percentage points compared with the past five years due to a shift in the payments mix, with revenue from consumer digital account-to-account payments expected to outpace cards through 2027 (half the rate of the past five years). In addition, card margins are compressing in some markets and the cash-to-noncash conversion will progressively reach maturity in a few cashless societies. Between 2022 and 2027, non-transaction related revenues are likely to grow by 5.7%, well below the prior five-year CAGR of 7.9%.

Companies across the payments industry are facing a host of disruptions that will challenge even the most experienced, including the rapid growth of real-time payments and value-added services and the commoditization of pure payment processing. Another disruptor is the steady expansion into payments by new entrants, with more than 5,000 fintechs now operating in the payments space globally and accounting for approximately $100 billion of total industry revenues. BCG’s report projects these businesses will continue to intensify competitive pressure on incumbents and command a revenue pool of up to $520 billion by 2030.

An Evolving Landscape for Industry Players

According to the report, revenues for the acquiring industry could soar by 6.9% annually over the next five years, taking the global revenue pool to $100 billion by the end of 2027. However, for issuers, the growth wave they have long been riding is beginning to break. Globally, from 2017 to 2022, revenues for issuers rose at a CAGR of 8% but the report forecasts that issuer revenues globally will grow by a CAGR of just 5.5% from now through 2027. Transaction banking is a $536 billion market globally today and is expected to grow at an annual rate of 6.6%, becoming a $738 billion market by 2027.

With nearly every element of the global payments ecosystem undergoing a rebuild, there is a unique opportunity for infrastructure players and various other payments market stakeholders to define the future of payments and their roles within it. The report estimates that alternative payment methods will grow about three times as fast as card payments from 2022 to 2027. Digital currencies are moving from concept to reality, as more than 90% of central banks actively experiment with them as a complement to cash, according to the Bank for International Settlements. At current rates of development, retail and wholesale central bank digital currencies could be operational in some countries in every region in five to ten years.

Transforming Ambiguity into Opportunity

The report outlines four topics that are shaping the leadership agenda, along with short-term and long-term actions that organizations should take to navigate the challenges ahead:

• Operational Resilience: Payments providers have achieved solid operating performance over the past 24 months, with the average net revenues for a global sample of 20 large issuers, acquirers, payments processors, and card schemes rising 7.5% between 2021 and 2023. But total shareholder returns (TSR) for the largest players have fallen by 20% between 2021 and 2023, with sub sectors, such as acquiring and payments processing, witnessing the sharpest declines (roughly 40%) over this period. In the short term, organizations should make operational resilience and cost excellence a top priority to improve operating results while creating an integrated business, finance, and investor strategy to increase TSR in the long term.

• Generative AI: GenAI could transform many aspects of payments and deliver enormous benefits to companies and their customers, with many payments leaders already starting to use the technology. The impact of GenAI on specific payments operations could be profound. In product development alone, BCG analysis suggests companies could boost productivity by more than 20% at different stages of the coding journey. Short term, organizations should identify two or three high-impact use cases to begin leveraging GenAI, and build the tech architecture, governance, and skills to implement these use cases. Long term, organizations should scale GenAI across the company while focusing on the most important customer journeys.

• Risk Management and Compliance: In response to past misconduct and non-compliance by some payments institutions, regulatory authorities are taking a tougher stand and stepping up enforcement. The report recommends companies perform a brutally honest self-assessment on risk and compliance capabilities to close the most important gaps. Organizations should define and implement a target operating model to enable long-term resilience and professionalize risk management and compliance practices long term.

• Mergers and Acquisitions: Equity funding from private equity players and strategic investors in the payments fintech sector (excluding Stripe’s recent deal) has dropped to $1.5 billion as of the first quarter of 2023, significantly lower than the $5 to $8 billion in funding per quarter that payment fintechs realized during 2021 and the first half of 2022. BCG’s report forecasts ongoing high levels of M&A activity with a shift from mega-deals to capability-led acquisitions related to alternative payments methods, integrated software vendors, value-added services, and loyalty programs. It recommends that organizations refresh their partnership strategy to identify and realize current M&A opportunities at attractive valuations while integrating M&A and partnerships to complement in-house built capabilities in the long term.

“The tumultuous past few years have underscored how extraordinarily dynamic and resilient the payments industry is; however, this nonstop disruption has begun to take its toll,” said Markus Ampenberger, a BCG partner and coauthor of the report. “To navigate the challenges ahead, organizations must confront disruption head-on and take decisive action to enable sustainable growth and turn disruption into a source of long-term advantage.”

Download the publication here.