2021 saw another record year of self-checkout shipments, with 200,000 units delivered worldwide

Vibrant market sees new entrants

Vibrant market sees new entrants

Shipments of self-checkout units increased by 11% last year, according to Global EPOS and Self-Checkout 2022, a new study by strategic research and consulting firm RBR.

Alongside sustained demand for self-checkout in the grocery sector, an increasingly wide range of retailers are embracing the technology, opening up opportunities for suppliers.

The research shows an expanding range of options for retailers, with more than 30 vendors present, including both international players and domestic suppliers.

NCR remains the world’s largest supplier of self-checkout

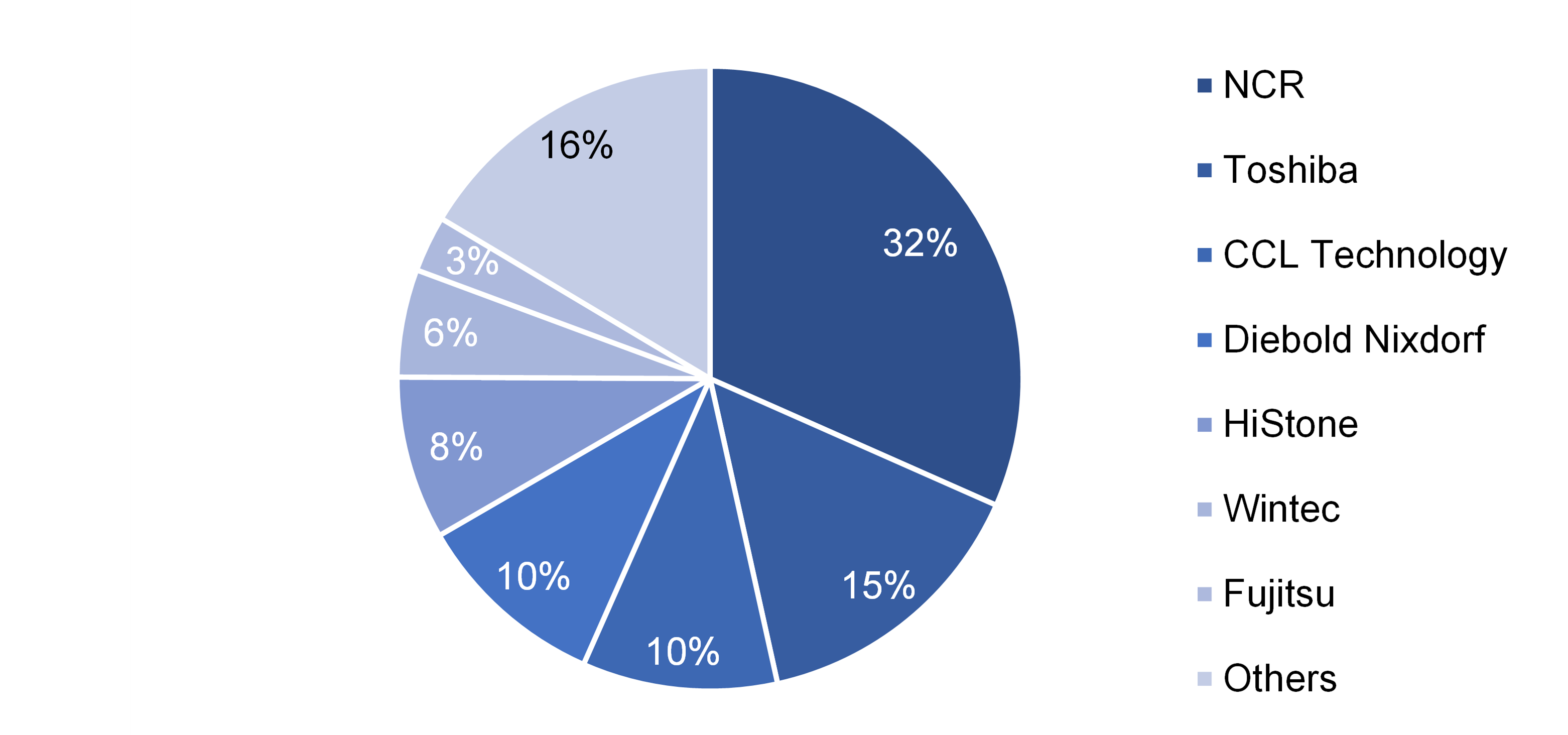

NCR maintains its place as the largest supplier of self-checkout terminals, delivering more than 60,000 units. The vendor leads in all but one region, with customers including supermarket chain Biedronka in Poland, Asda in the UK and Walmart in multiple countries around the world.

Toshiba is the second largest supplier. More than 90% of the vendor’s terminals were delivered to the USA and its home market Japan, with major customers including pharmacy firm CVS and convenience store chain Family Mart.

Challengers increase their share of shipments

Chinese firm CCL Technology is the third largest supplier, leading in Asia-Pacific and with a growing presence in Europe, where French supermarket chain Monoprix is rolling out its terminals.

Diebold Nixdorf’s market share grew in 2021, with shipments up by nearly a third. The vendor has a strong foothold in Europe through customers such as furniture retailer IKEA and discounters Lidl and Aldi.

Rounding out the seven largest vendors globally are Chinese firms HiStone (formerly Hisense) and Wintec, both supplying major retailers in their home market, and Japan’s Fujitsu, which has a strong presence in North America.

Suppliers’ Share of Self-checkout Shipments Worldwide, 2021

Some retailers opt to use local suppliers, or their own solutions

The remainder of the market is highly fragmented, with regional and local vendors present, such as ITAB and 4POS in Europe, Digi in Japan and Laurenti in Brazil. Some major retailers, including Dollar General and Home Depot in the USA, are taking an alternative route, building their own self-checkout solutions.

As the market continues to grow, the technology is also evolving, with solutions using RFID and computer vision being deployed. For example, international convenience chain Circle K is rolling out AI-powered self-checkouts from US firm Mashgin across its store network in 2022. Alan Burt, who led RBR’s research, remarked: “With an increasingly diverse range of self-checkout products on offer, retailers of all sizes across grocery, convenience, DIY and fashion sectors are able to choose the solution which best suits their particular needs”.