RO e-Factura, the national electronic invoicing system, which is mandatory for B2B companies from 1st July, does not bring visible benefits for the business environment, the positive economic effects being visible in time and only if the new system will be applied in all areas of activity, according to NextUp, a software solutions company, which has implemented a solution for transferring data from invoices automatically to the National Tax Administration Agency (ANAF).

“I do not see any obvious benefits for the private sector. Neither this time the authorities have not worked out mechanisms for extracting information from invoices automatically. The economic benefits, such as the reduction of tax evasion, will be seen in time, not immediately, and only if the national invoicing system will apply in any field of activity, not just in a few areas – food commerce (fruits, vegetables, other plants), alcoholic beverages, clothing and footwear and new construction – for which it applies from 1st July”, Roxana Epure, Managing Partner NextUp, points out.

In order to simplify the work processes of merchants, NextUp has recently introduced, in its own software, such as ERP, inventory management and accounting, a solution for automatic transmission of invoice data to ANAF. Thus, the automated transfer of invoice data in XML format, the format desired by the public authorities, takes between 3 and 5 minutes for all invoices compared to at least 10 minutes per invoice for manual data entry.

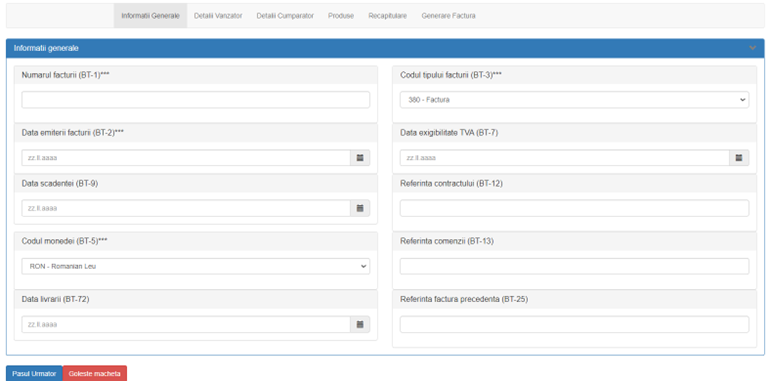

In the ANAF form, containing 13 mandatory fields for reporting data in the national invoicing system, companies must provide general information from each invoice, details about the seller, details about the buyer, and details about each product or service on the invoice. Therefore, entering data manually takes approximately 10 minutes, depending on the ability of the operator.

“In a simple simulation, with an average of 10 minutes per invoice, and an average of 250 invoices per month per merchant, the reporting of invoice data will take more than 41 hours, which is equal to one week in a working month. It is an enormous consumption of time. The employees will be blocked with such a report instead of accomplish other more important tasks, which means extra costs for employers, without adding value to their business. Unfortunately, the digital invoice or e-Invoice is, at the moment, a report to the public institutions, not a real invoice. Thus, in order to remove one more responsibility for entrepreneurs and employees, we have simplified the procedure by implementing a solution that automatically and correctly retrieves data from invoices. Thus, the invoice data can be reported to the ANAF system with just a few clicks, in minutes, even for hundreds of invoices at the same time,” Roxana Epure, Managing Partner NextUp, explains.

“In a simple simulation, with an average of 10 minutes per invoice, and an average of 250 invoices per month per merchant, the reporting of invoice data will take more than 41 hours, which is equal to one week in a working month. It is an enormous consumption of time. The employees will be blocked with such a report instead of accomplish other more important tasks, which means extra costs for employers, without adding value to their business. Unfortunately, the digital invoice or e-Invoice is, at the moment, a report to the public institutions, not a real invoice. Thus, in order to remove one more responsibility for entrepreneurs and employees, we have simplified the procedure by implementing a solution that automatically and correctly retrieves data from invoices. Thus, the invoice data can be reported to the ANAF system with just a few clicks, in minutes, even for hundreds of invoices at the same time,” Roxana Epure, Managing Partner NextUp, explains.

According to the law for the implementation of the national system RO e-Invoice and electronic invoice, promulgated by the President of Romania in mid-May, the data must be exported only in XML format in order to be uploaded to the ANAF system. After issuing the XML file from a software, it must be uploaded to the Virtual Private Space (SPV) on the ANAF website. Targeted B2B merchants are required to report invoice data from 1st July regardless of whether their clients or suppliers are listed in the SPV.

In addition to e-Invoice system reporting, as part of digitizing the relationship between business and Government, NextUp has also implemented a SAF-T reporting solution, a complex reporting of all company information that becomes mandatory for large taxpayers from July 1, after a grace period of six months.