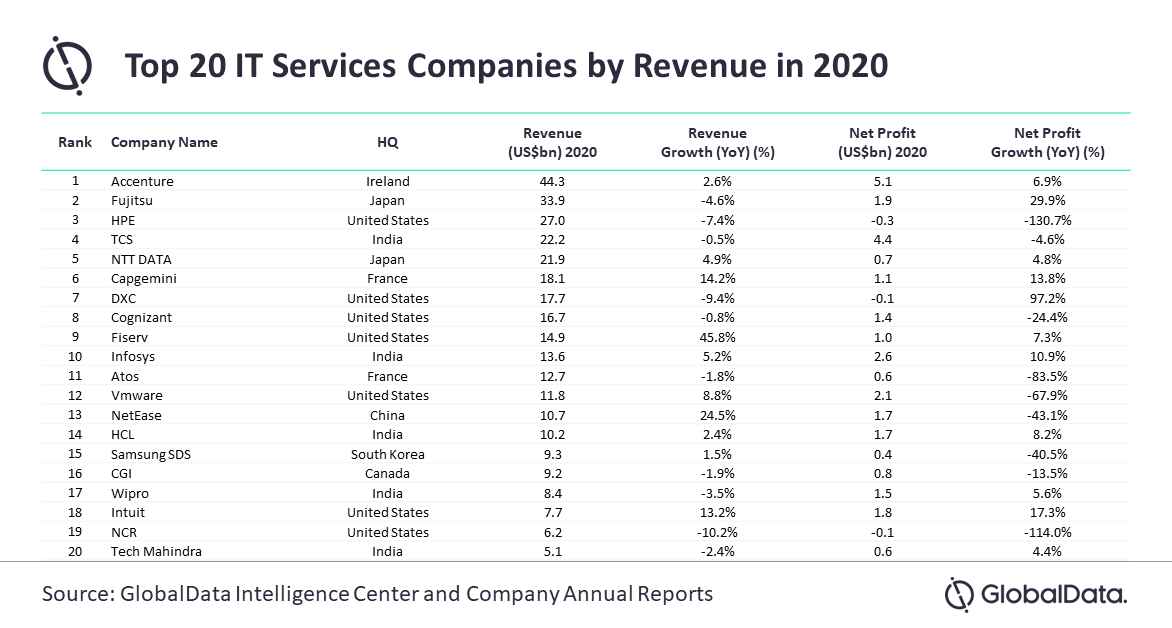

For IT service providers, 2020 was one of the most challenging years for revenue growth. Their profitability fell as organizations resorted to cost optimization amid the COVID-19 crisis. According to analysis by GlobalData, a leading data and analytics company, 50% of the top 20 IT service providers by revenue reported YoY revenue decline in 2020, while nine saw a drop in net earnings.

Keshav Kumar Jha, Business Fundamentals Analyst at GlobalData, comments: “Conditions could remain challenging for IT service providers as cost-optimization strategies necessitated by the COVID-19 pandemic will likely become long term. However, IT infrastructure and application outsourcing service providers may benefit considerably from the digital transformation adopted by organizations amid the health crisis.”

Gary Barton, Principal Analyst for Business Network and IT Services at GlobalData, stated: “Many IT companies have experienced customers delaying IT transformation projects as enterprises struggle to understand what their businesses will look like in terms of new working practices after the pandemic. There is an opportunity for IT companies to engage with enterprises and help them build the business models of the future – the IT companies who seize this opportunity will be well placed to grow revenues. There is also a lot of faith being put in new technologies such as 5G, IoT and edge networking/compute to generate new IT revenue growth. The use cases for these technologies are still being developed, but there are clear rewards for IT companies that can demonstrate clear business/consumer benefits of these technologies. Finally, there are signs that smaller businesses are becoming more attuned to the benefits of being more digital. Funding schemes such as NextGenerationEU are providing potentially billions of Euros to help enterprises adopt new technologies and this spending will benefit IT providers.”

Jha highlights some key companies from the ranking and offers insight:

HPE and NCR – Net earnings plunged

Hewlett Packard Enterprise (HPE) and NCR reported a decline of over 5% in revenue and their net profit decreased more than 110%.

Jha comments: “Adding to the competitive pricing pressure, the COVID-19 pandemic caused manufacturing capacity constraints in North America, supply chain disruption, delay in completing on-site installations, and reduction in worldwide demand. This resulted in a decline in HPE’s YoY revenue. The company’s profitability also decreased due to subdued revenue growth.

“The shift from selling perpetual software licenses to recurring revenue in banking, retail and hospitality verticals was the prime reason for the decline in NCR’s revenue and net earnings.”

DXC Technology – Net loss declined

DXC Technology reported over 5% decline in its YoY revenue, mainly due to the termination of projects, the disposition of business and completion of projects, besides a decrease in the number of run-rate projects volume.

The disposition of the US State and Local Health and Human Services (HHS) business and cost optimization enabled the company to reduce its net loss.

Fiserv, NetEase, Capgemini and Intuit – Double digit growth in revenue

Fiserv, NetEase, Capgemini and Intuit were the four major companies within the top 20 ranking that reported double-digit revenue growth in 2020.

Jha continues: “Fiserv’s revenue growth was mainly due to the incremental revenue from the acquisition of First Data Corp in July 2019, while increase in revenue from online gaming and higher-learning services helped NetEase clock over 24% YoY growth.

However, increase in revenue sharing costs with game developers, distribution channel providers and other third parties along with increasing tax liabilities led to a decline in NetEase’s net earnings.

Besides the acquisition of Altran, growth in digital and cloud service businesses due to the prioritization of digital transformation projects by clients worldwide helped increase Capgemini’s YoY revenue. Intuit reported growth in revenue from TurboTax Live and TurboTax federal units, apart from its Online Ecosystem, in 2020”.